Business Analytics for Venmo Card

Venmo

Venmo has been a well-known peer-to-peer payment platform for the past decade. The Venmo mobile app enabled sending money easily among friends and strangers. No credit card, no wallet, and no fees are required. Just link the app to a debit card or checking account and anyone in the US can send and receive money right away.

Monetization

Venmo accumulated a customer base over 40 million through its ease-of-use P2P service. It's now critical for the company to turn the business into profitibility using its huge user base.

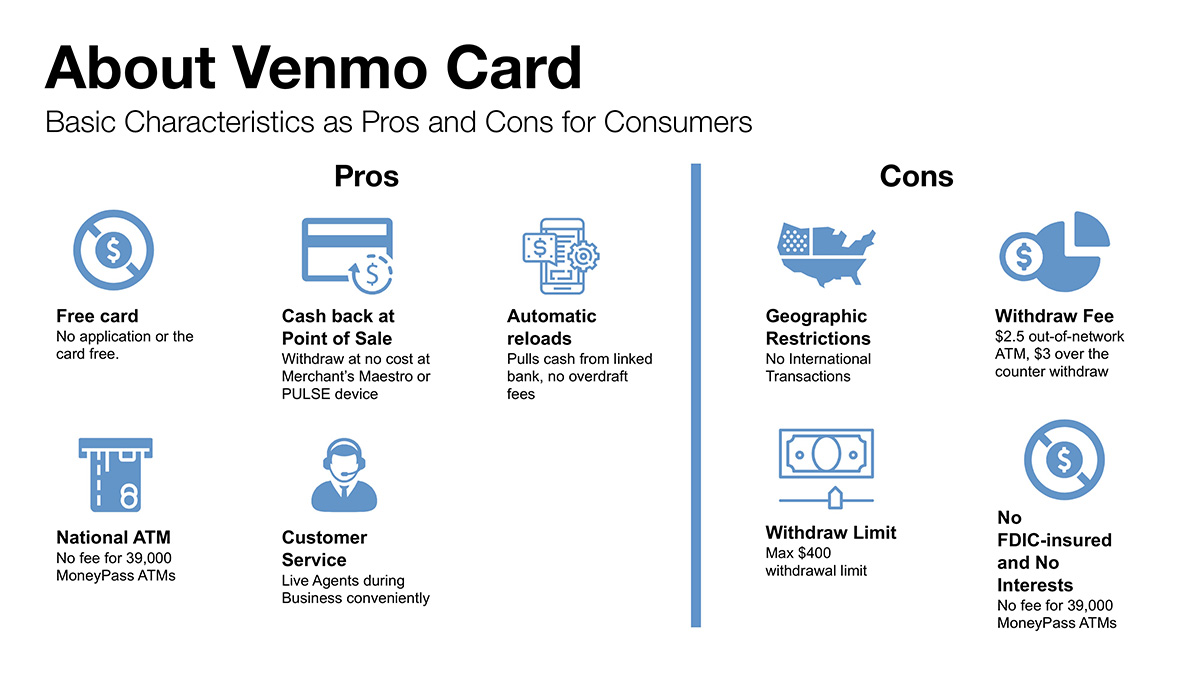

Venmo's current biggest profit generator is instant transfer, which is generated from users paying fees to have money transferred to their bank faster than a typical two-day wait period. The Venmo debit card, also known as Venmo card is another new product for monetization. The interchange fees paid by merchants whenever Venmo Customers swipe their Venmo debit cards will be a big revenue generator for the platform.

KPIs

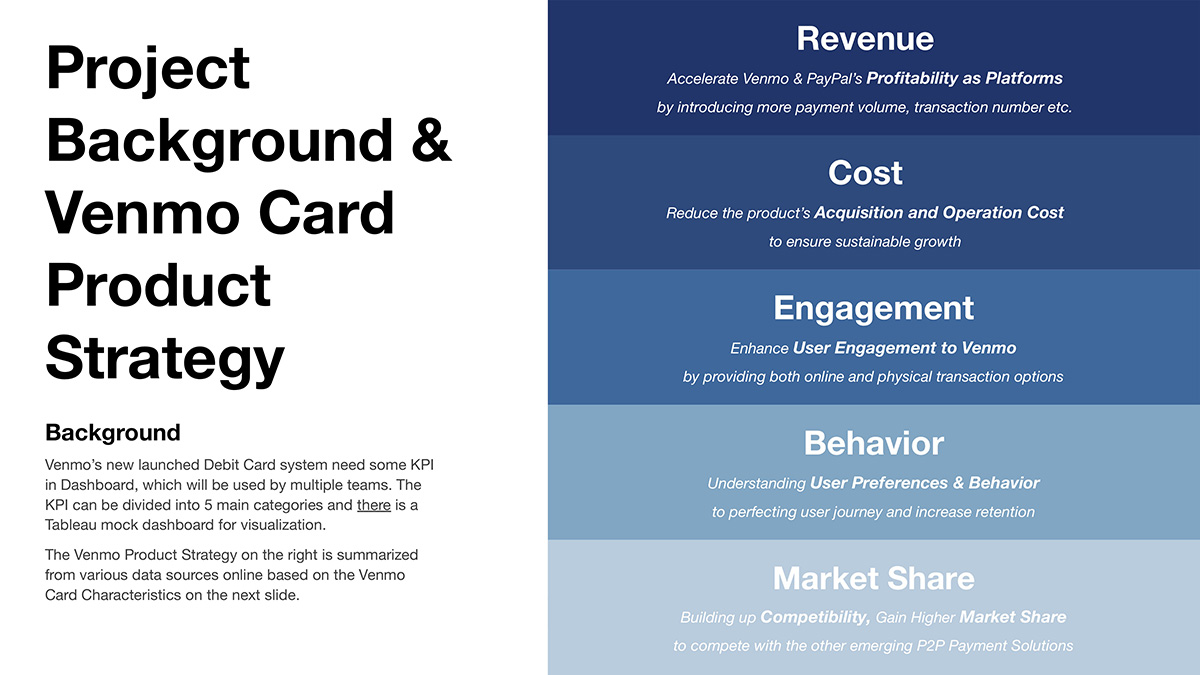

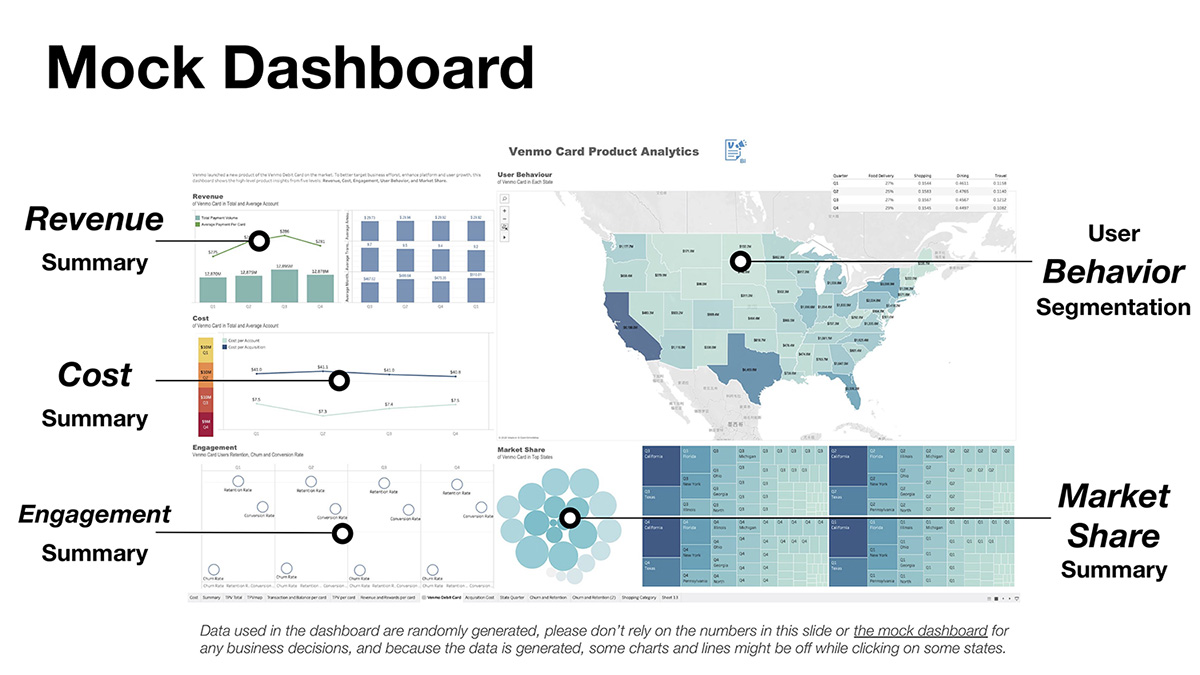

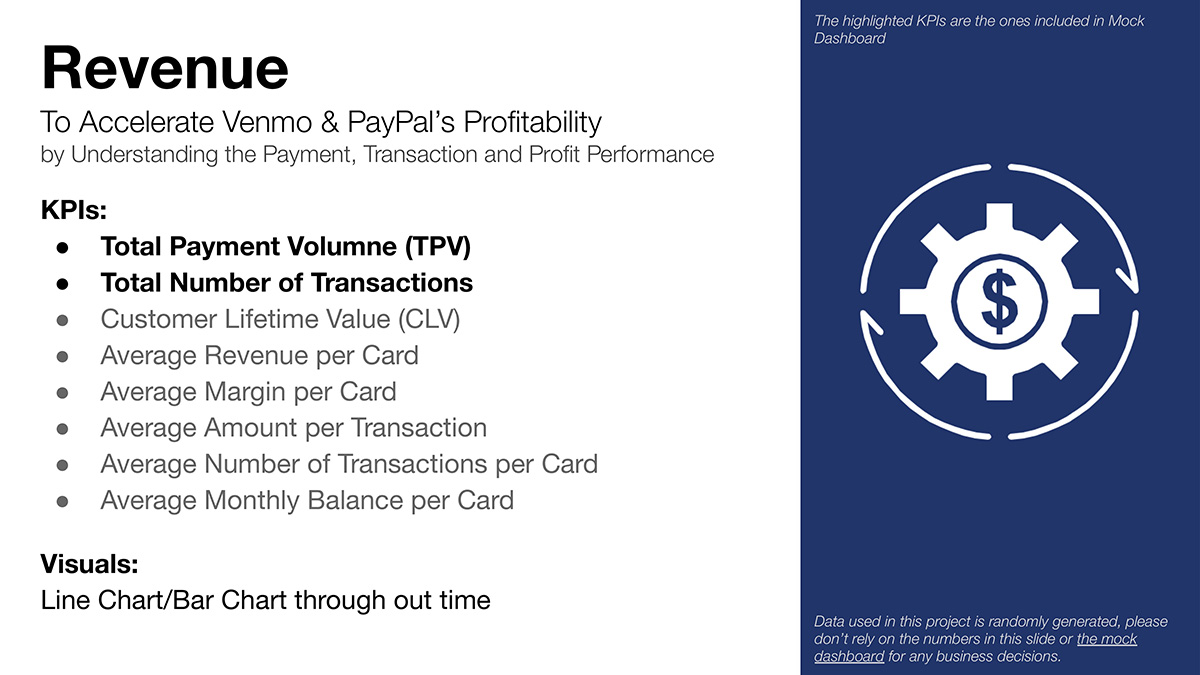

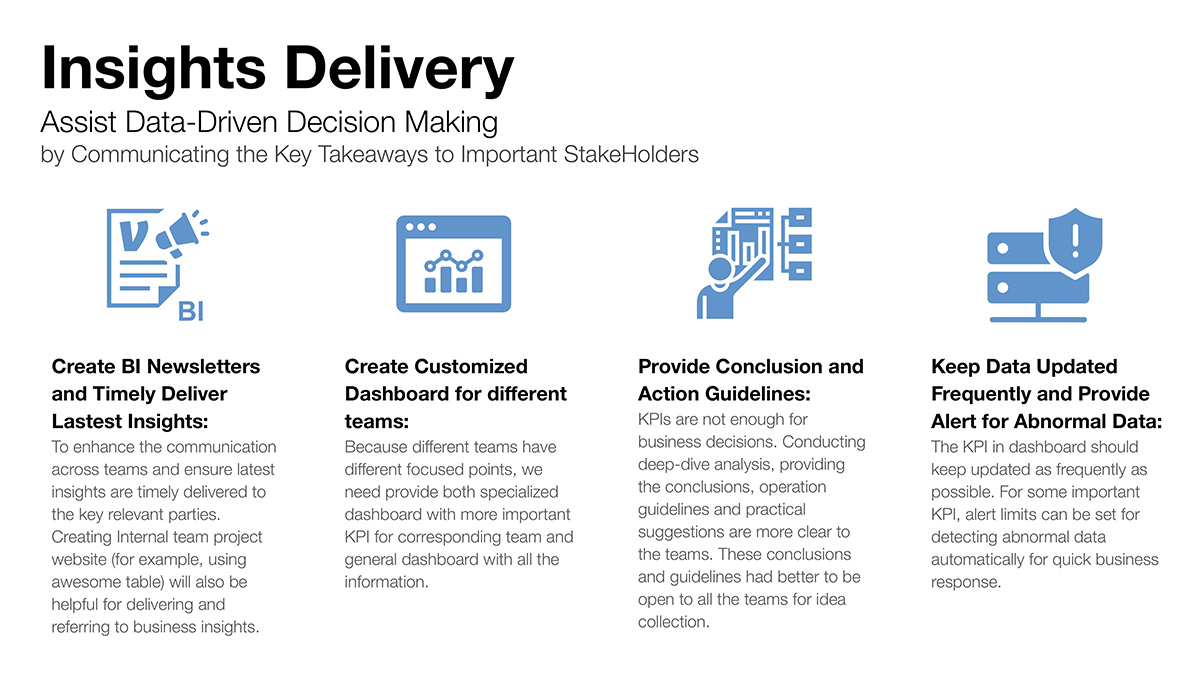

In this project, I will suggest a group of KPIs for Venmo’s new launched Debit Card, assuming these will be used by multiple teams. The KPIs are divided into 5 main categories and there is a mock Tableau dashboard for visualization. The Venmo Product Strategy is summarized from various data sources online based on the Venmo Card Characteristics.

This project only represents my own opinion.